Back to the Old Normal

Turn on your financial news channel of choice, and there seems to be lots of chatter about the “high” level of interest rates. I agree that it “feels” like rates are very high, but are they really? Early on in our career (late 1990’s) clients would scoff at the idea of buying a 4% municipal bond. After all, stock market returns were averaging mid double digits throughout most of the 1990’s so a 4% “muni” was BORING even if it was free of federal income taxes.

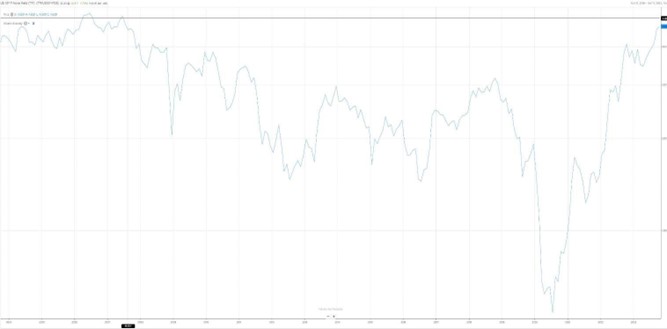

Today we have interest rates at levels not seen since circa 2007. See the chart below of the yield on the US 10 year Treasury (obtained from FactSet):

This means that there is a significantly higher cost of capital, as compared to the prior 15 or so years as interest rates generally dropped over that period, culminating in historically low levels immediately following the Covid-19 pandemic.

The major move upward from the lows in 2020 are a major factor in the downward price movement we have seen in many asset classes. It is as if we have hit a “reset button” and have re-calculated what assets are worth given the level of interest rates. This paradigm shift has been painful, for sure, but it just means that investors should re-think how they invest. No longer do you have to limit your portfolio to equities or physical real estate to earn a good return.

Many have piled into money markets and CD’s to earn 5%+ yields and hide from market risks. That is fine now, but as the economic picture plays out, that leaves lots of cash with which investors can make investments to try and increase their return. You may want to participate in the performance of assets that have the potential to earn more than cash. We believe that there are attractive valuations in bonds and stocks which may provide attractive returns in the coming years. It is important to speak with your advisor to devise a plan that will help you reach your financial goals. It is also a good time to revisit your retirement plan to see if you remain on track toward your retirement date and desired lifestyle.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making any investment decision, please consult with your financial advisor about your individual situation. Any opinions are those of the author, and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

This article was written by Gus Vega, CERTIFIED FINANCIAL PLANNER, Total View Advisors and Branch Manager with RJFS and Danny Brea, CERTIFIED FINANCIAL PLANNER, Total View Advisors and Financia Advisor with RJFS. They can be reached at 786.264.4954, 9155 S. Dadeland Blvd. # 1014, Miami, FL 33156. Total View Advisors is not a registered broker dealer and is independent of Raymond James Financial Services, Inc. Securities offered through Raymond James Financial Services, Inc., member FINRA / SIPC. Investment advisory services offered through Raymond James Financial Services Advisors, Inc.